22 Jan

AI Chatbot and Callbot Made Si...

AI chatbots and callbots are no longer limited to answering basic customer questions. In recent years, businesses have started using

22 Jan

The New MySSS Card: One ID, On...

The Social Security System (SSS) has officially launched the MySSS Card, a next-generation ID that also works as a debit

22 Jan

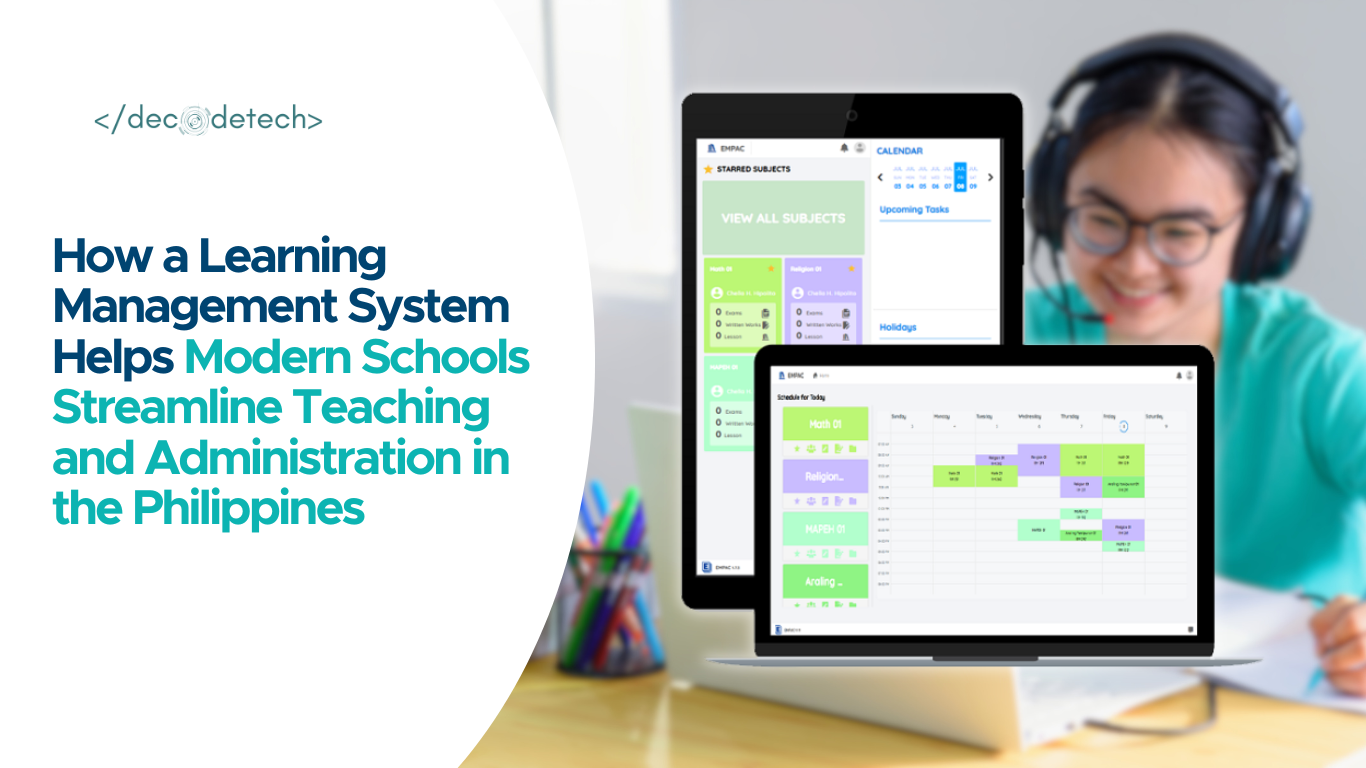

How a Learning Management Syst...

The education landscape in the Philippines is evolving at a rapid pace. Schools that still rely heavily on manual, paper-based

21 Jan

BIR Form 1604-C Guide 2025: Ph...

As the year closes, HR and accounting teams across the Philippines face one of their biggest annual tasks, preparing and

24 Oct

ERP System Philippines: Best P...

Running a business without an ERP System can feel like juggling too many balls at once. Inventory, sales, HR, accounting,

20 Oct

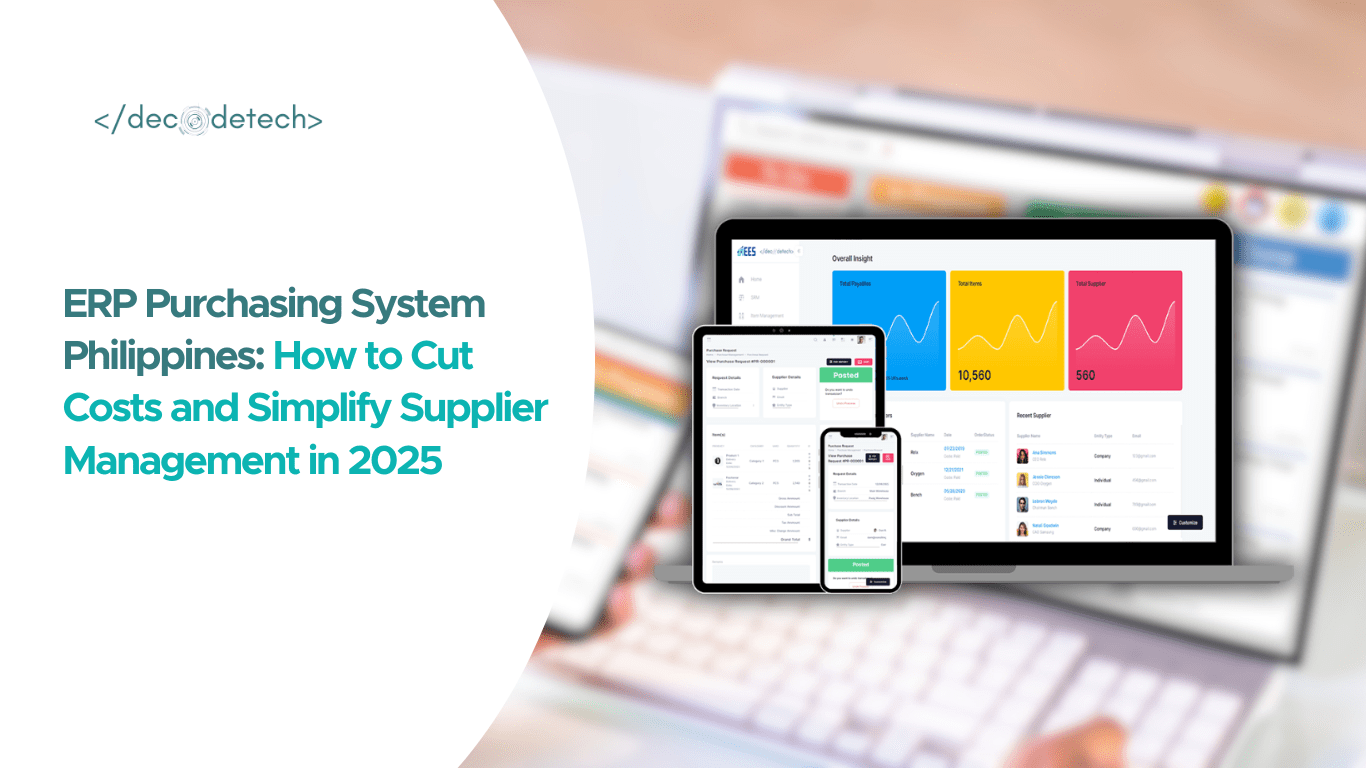

ERP Purchasing System Philippi...

ERP Purchasing System is the smarter way to manage supplier orders, yet many teams still rely on emails, spreadsheets, and

16 Oct

ERP Training Management System...

An ERP System (Enterprise Resource Planning System) is only as powerful as the people who use it. Even the best

13 Oct

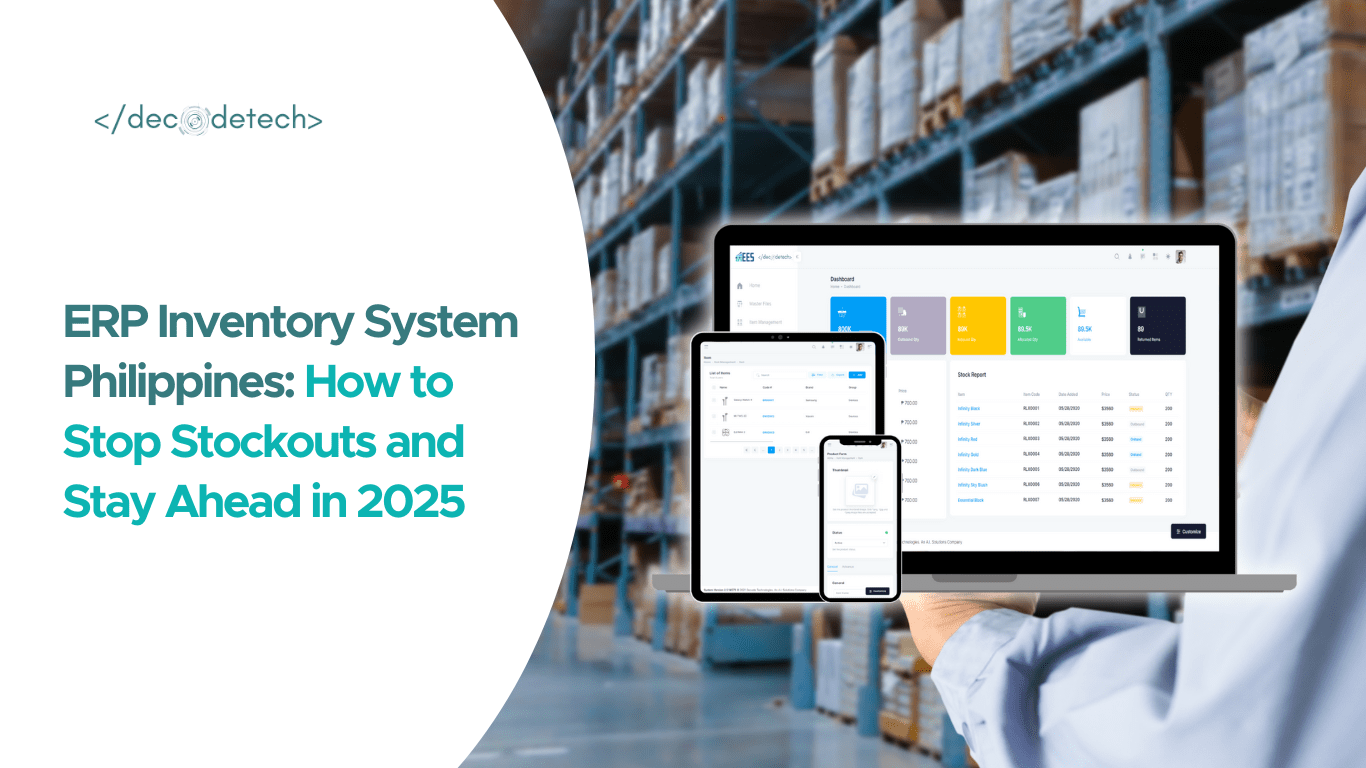

ERP Inventory System Philippin...

It’s the middle of your busiest sales week, and your best-selling item is suddenly out of stock. Orders pile up,

10 Oct

ERP Sales System 101: Why Orde...

An ERP Sales System does more than handle orders, it keeps sales, operations, and finance aligned through shared, real-time data.

06 Oct

ERP System Philippines: How to...

Your sales team is still chasing invoices in email threads. Inventory updates only happen at the end of the day.