Business Insights

BIR Form 2316: Everything You Need to Know About Filing Your Taxes

23 Oct

In the Philippines, BIR Form 2316 is an important document for both employees and employers, providing essential details about an individual’s annual income, taxes withheld, and benefits. It plays a crucial role when it comes to filing an Income Tax Return (ITR) and identifying non-taxable benefits.

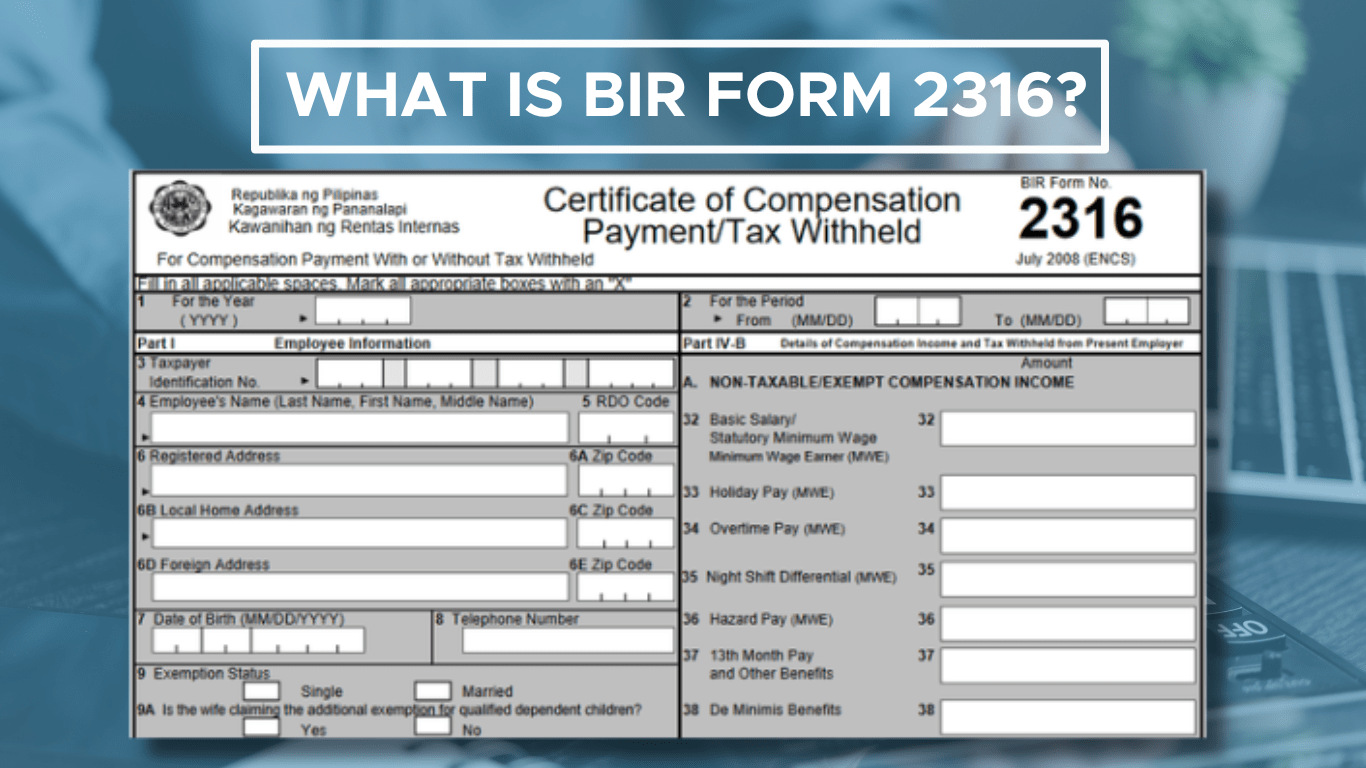

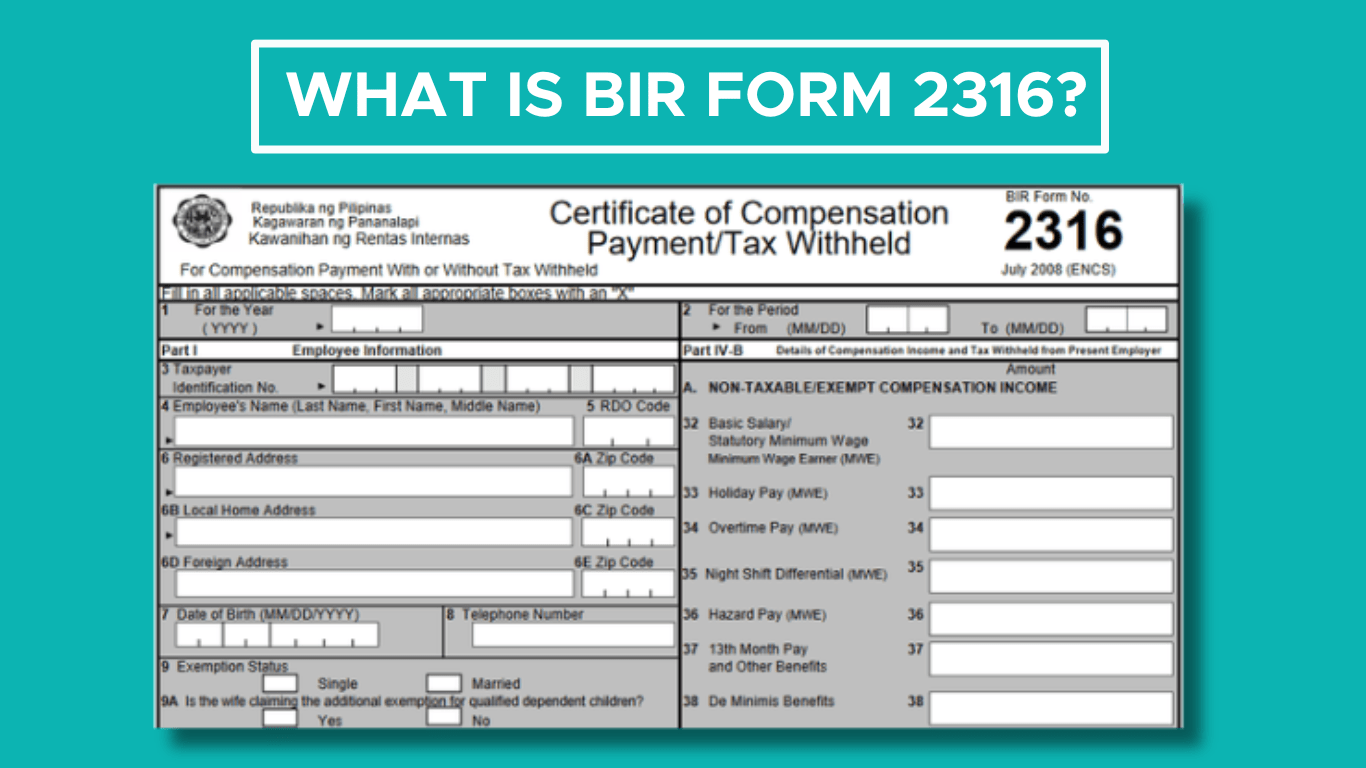

What is BIR Form 2316?

BIR Form 2316, also known as the Certificate of Compensation Payment/Tax Withheld, is an official document that summarizes an employee’s income for the year and the taxes that were withheld by the employer. It is typically issued by the employer to employees at the end of each year and is submitted to the Bureau of Internal Revenue (BIR).

The form serves as a verification that the correct amount of taxes has been deducted from the employee’s salary, ensuring compliance with Philippine tax laws.

How BIR Form 2316 Influences your Tax Filing?

For employees, BIR Form 2316 is an essential document when filing Annual Tax Returns . This form provides crucial information, including the total compensation received during the year, the amount of tax withheld by the employer. Accurate information from this form is necessary to prevent discrepancies or miscalculations in tax filings. Additionally, when changing jobs, it is important to ensure that both your former and current employers issue their respective forms for the duration of your employment.

How to Effortlessly Download and Submit BIR Form 2316?

Employers are responsible for providing BIR Form 2316 to their employees, but if you find yourself without a copy, don’t worry! You can download a blank version from the BIR to review or fill out as needed.

Remember, though, that the official form should come from your employer. If you haven’t received it by the end of January, make sure to follow up with your HR or payroll department. It’s important to get this document on time, as it plays a vital role in making sure your tax return is accurate and submitted correctly.

Check the Accuracy of Your BIR Form 2316

It’s really important to ensure accuracy when submitting BIR Form 2316. Even small mistakes can lead to issues with your tax filings. To avoid any problems, employees should take a moment to double-check their personal details, such as their name and tax identification number.

It’s also crucial to verify the amounts reported for taxes withheld and gross compensation to make sure everything is correct. Don’t forget to accurately include any non-taxable benefits, like bonuses or allowances.

Employers need to submit this form to the BIR on time and provide a copy to their employees to avoid any penalties. Taking these steps helps everyone stay on track!

What Happens When There Are Errors on BIR Form 2316?

Errors on BIR Form 2316 can create substantial challenges for both employers and employees, potentially resulting in incorrect tax calculations and associated penalties. Employees are encouraged to report any discrepancies to their employer as soon as they are identified to facilitate prompt corrections.

Employers should undertake a meticulous review of the form prior to distribution. By ensuring that all tax deductions and benefits are accurately documented, they can significantly reduce the likelihood of complications during the tax filing process.

Achieving Compliance with a Solid HR and Payroll System

Taxes and benefits don’t have to be intimidating. By understanding BIR Form 2316, the basics of income tax filing, and the value of non-taxable benefits, you can stay on top of your financial responsibilities. And with the help of a good HR and Payroll System, both employees and employers can enjoy peace of mind, knowing that everything is managed smoothly and in compliance with the law.

Recent Posts

- Virtual Pag-IBIG: What Employers and Employees Need to Know in the Philippines February 10, 2026

- Payslip in the Philippines: Meaning, Sample, and Common Payroll Errors to Avoid in 2026 February 10, 2026

- Organized Recruitment Process: How Structured Hiring Improves Outcomes February 7, 2026

- Unlocking Potential in 2026: How AI Assistants Boost Business Efficiency January 29, 2026

- Switching Payroll Providers in Manufacturing: What PH Businesses Should Evaluate 2026 January 27, 2026